Retire is a verb. |

Take action now!

Help your client understand the cost of waiting to retire

Millennials have surpassed Baby Boomers as the nation's largest living adult generation.* And they are getting ready to retire. But are they prepared?

Just like their parents — this next generation of retirees is poised to redefine life in retirement. And you can help them do it.

Create an ACTion plan

A lot of things can stop a client from meeting their retirement goals. Don’t let inaction be one of them. Follow our A.C.T. plan to discover how to appeal to a younger clientele – and how our IncomeShieldTM fixed interest annuities can help.

Account

for retirement expenses

Calculate

for retirement income sources

Take Action

on guaranteed income solution

Learn more about IncomeShieldTM fixed interest annuities

Create an ACTion plan

A lot of things can stop a client from meeting their retirement goals. Don’t let inaction be one of them. Follow our ACTion plan to discover how to appeal to a younger clientele — and how our IncomeShieldTM fixed index annuities can help.

Account

for retirement expenses

Calculate

for retirement income sources

Take Action

on guaranteed income solution

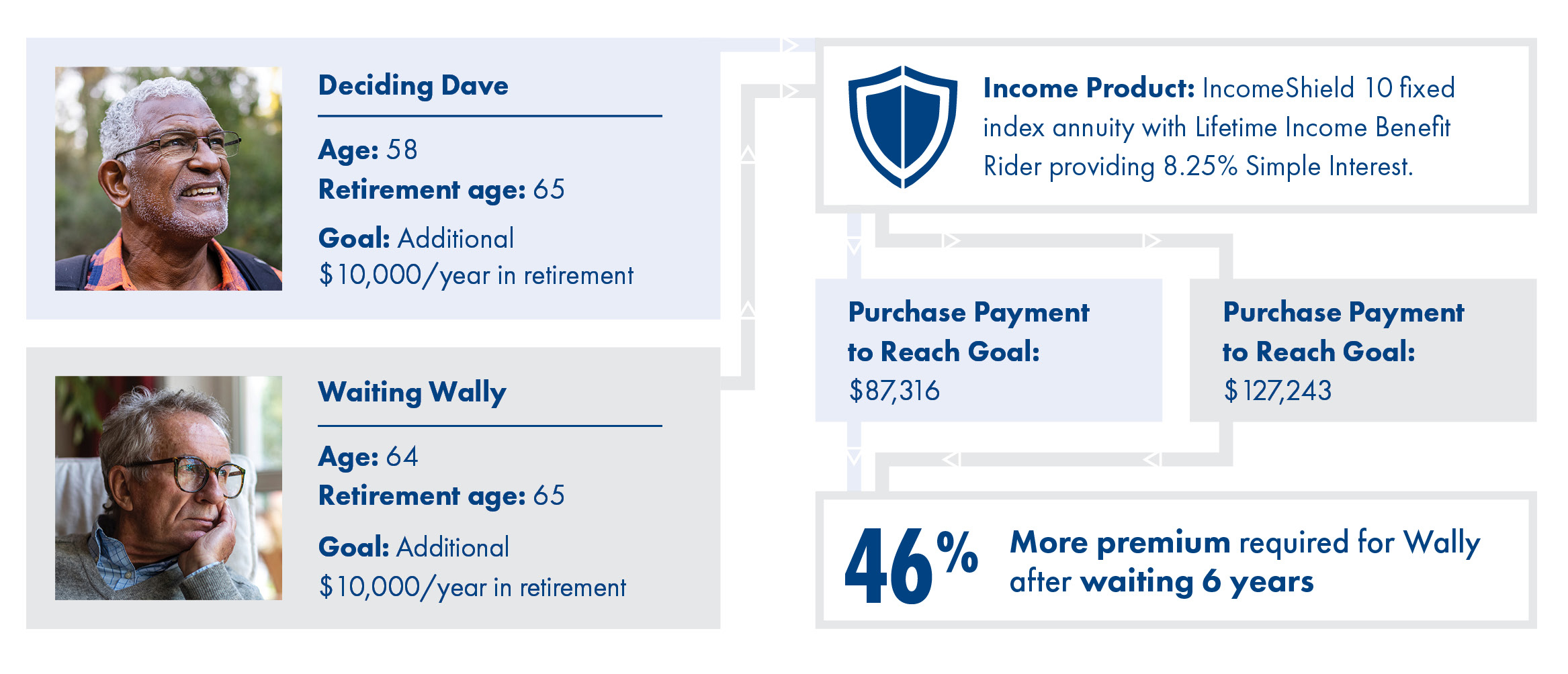

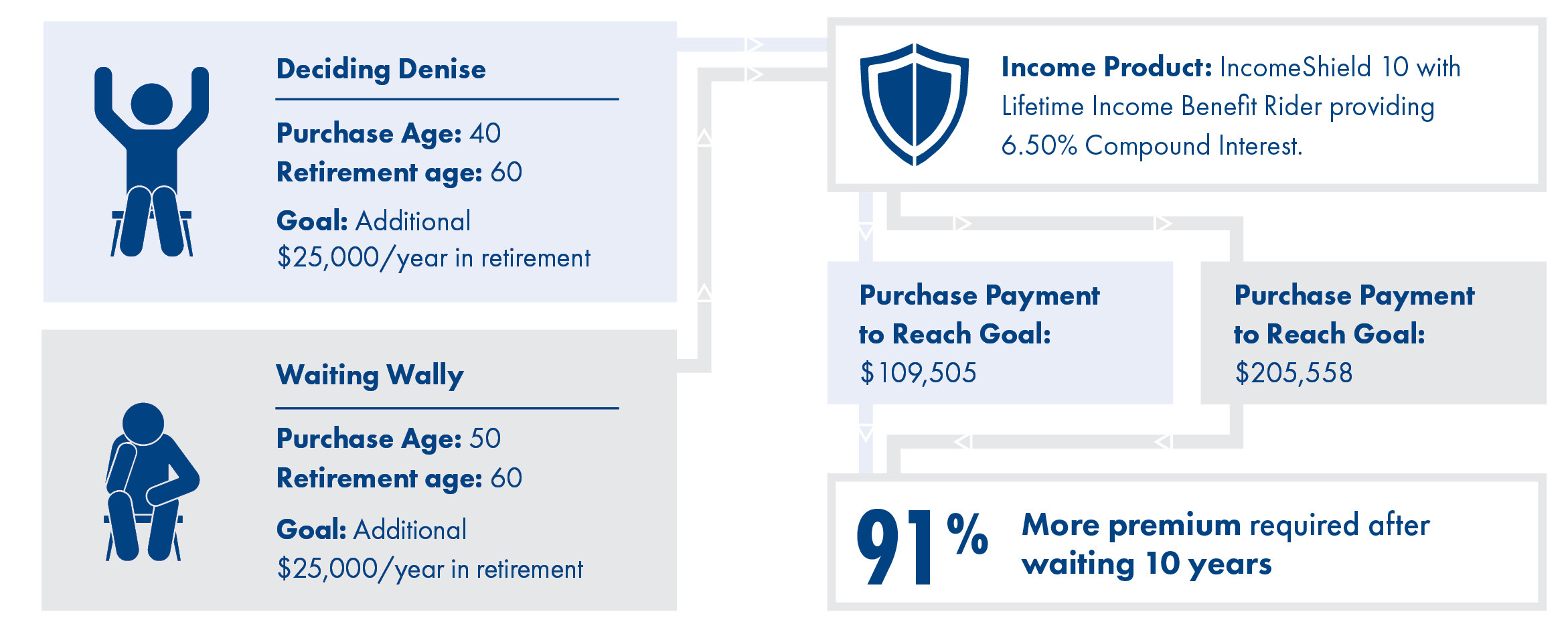

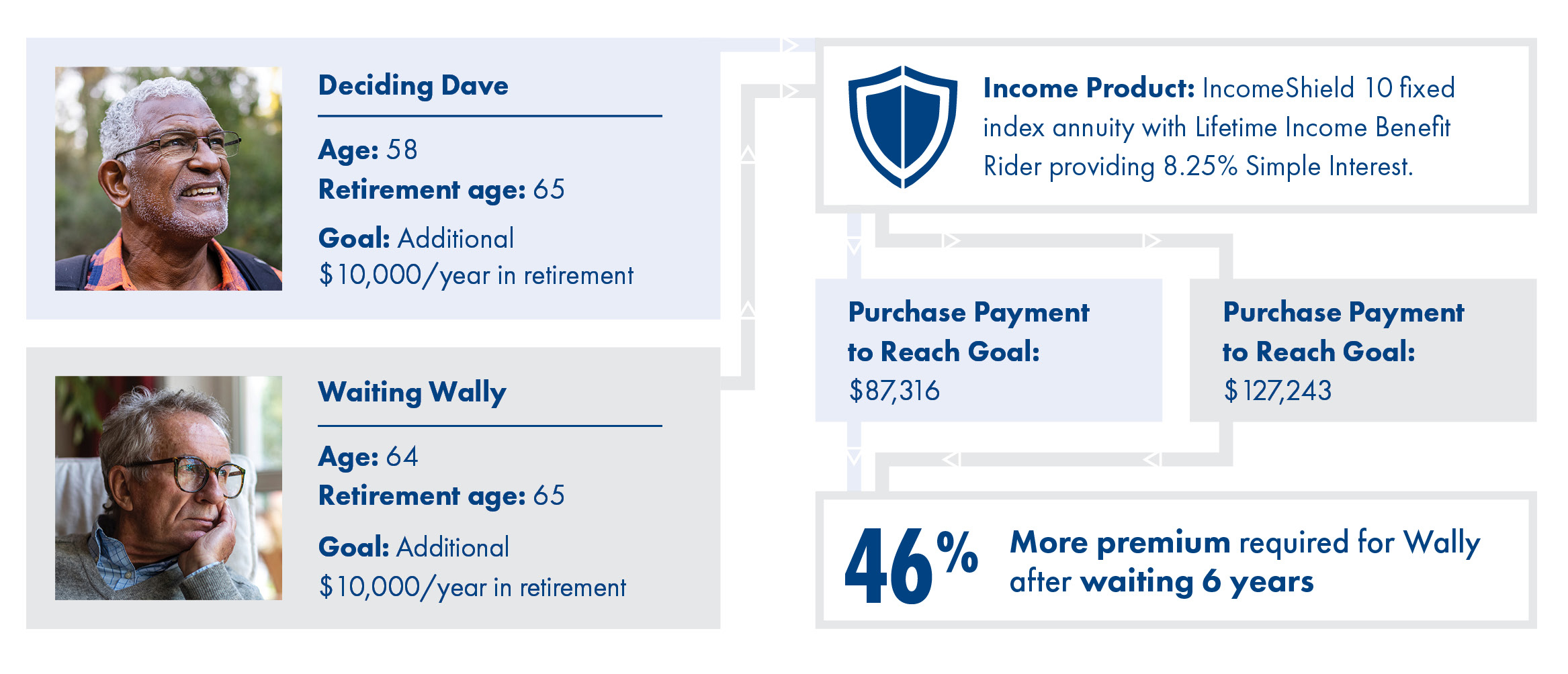

What's the Cost?

Understanding the cost of inaction can be an opening insight to clients starting to prepare for retirement. Take, for example, these hypothetical example case studies where dig into how much waiting can cost clients in lifetime income.

10 years?

Foundation Focused

Wants to retire early

Needs safe withdrawal to retire in the next 20 years

Motivated to purchase guaranteed income early

5 years?

Cashflow creators

Wants to retire in the next 15-10 years

Needs $15,000 in supplemental retirement income

Motivated to reinvest excess capital for lifelong accumulation

10 years?

Foundation Focused

Wants to retire early

Needs safe withdrawal to retire in the next 20 years

Motivated to purchase guaranteed income early

5 years?

Cashflow creators

Wants to retire in the next 15-10 years

Needs $15,000 in supplemental retirement income

Motivated to reinvest excess capital for lifelong accumulation

Opens in a new window.

Opens in a new window.Foundation Focus: Less premium for more income

Two retirees. Same goal. 10 years difference.

Opens in a new window.

Opens in a new window.Cashflow Creators: Less premium for more excess capital

Purchasing guaranteed lifetime income for lifelong accumulation.

Acting earlier can benefit your client

Share our hypothetical scenario of two pre-retirees with the same retirement timing and income goals.

Both choose a fixed-index annuity to generate income, but one does so at age 58; the other at 64. See how their earning potential differs.

Acting earlier can benefit your client

Share our hypothetical scenario of two pre-retirees with the same retirement timing and income goals.

Both choose a fixed-index annuity to generate income, but one does so at age 58; the other at 64. See how their earning potential differs.

Acting earlier can benefit your client

Share our hypothetical scenario of two pre-retirees with the same retirement timing and income goals.

Both choose a fixed-index annuity to generate income, but one does so at age 58; the other at 64. See how their earning potential differs.

Acting earlier can benefit your client

Share our hypothetical scenario of two pre-retirees with the same retirement timing and income goals.

Both choose a fixed-index annuity to generate income, but one does so at age 58; the other at 64. See how their earning potential differs.

Make it come to life

Use our calculator to show your clients how their current retirement savings could be supplemented with an IncomeShield annuity.

IncomeShield can offer your clients a lifelong source of income

Learn about IncomeShield

Opens in a new window.Start training

Opens in a new window.For Agent Information Only. Not for use in solicitation or advertising to the public.

*Pew Research Center, Millennials overtake Baby Boomers as America's largest generation, April 28, 2020 (https://www.pewresearch.org/short-reads/2020/04/28/millennials-overtake-baby-boomers-as-americas-largest-generation/)

Annuity contract and Rider(s) issued under form series ICC22 BASE-IDX-B, ICC22 BASE-IDX, ICC22 IDX-11-10, ICC22 IDX-10-7, ICC20 E-PTP-C, ICC20 E-PTP-PR, ICC20 E-MPTP-C, ICC20 R-EBR, ICC16 R-MVA, ICC20 R-LIBR-FCP, ICC20 R-LIBR-FSP, ICC20 R-LIBR-W-FCP, ICC20 R-LIBR-W-FSP and state variations thereof. Availability may vary by state. For complete details please see product specific sales brochure(s) and disclosure(s).

This material is for informational purposes only, and is not a recommendation to buy, sell, hold or rollover any asset. It does not take into account the specific financial circumstances, investment objectives, risk tolerance, or need of any specific person. In providing this information American Equity Investment Life Insurance Company is not acting as a fiduciary as defined by the Department of Labor. American Equity does not offer legal, investment or tax advice or make recommendations regarding insurance or investment products. Each client has specific needs that should be discussed with a qualified legal or tax advisor.

Offered by American Equity. Other retirement options may also support similar goals.

6000 Westown Parkway, West Des Moines, IA 50266

.png?v=05222024205753)